Understanding Bitcoin's January Struggles and Future Prospects

Written on

The Current State of Bitcoin

Bitcoin's price has been relatively stable during January 2022, hovering within a narrow range. After ending 2021 at $46,306.45, it dipped below $44,000 on January 5 and has since fluctuated between $40,000 and $44,000. The $42,000 mark is particularly significant, serving as a critical support level that has remained intact despite challenges posed by volatile traditional markets and fears surrounding emerging COVID variants. Furthermore, U.S. Federal Reserve officials have indicated impending rate hikes to tackle persistent inflation.

This context has led many to view Bitcoin as a safeguard against inflation. However, as both traditional and crypto markets evolve, substantial investors are diversifying their portfolios across both realms. When one sector experiences a downturn, it often prompts a reallocation of assets, complicating Bitcoin's ability to detach from traditional financial trends. Nevertheless, the enthusiasm for Bitcoin remains strong, with retail investors actively "buying the dips" and institutional backers expressing continued support.

In the coming weeks, we will see if Bitcoin can rally back towards $50,000, contingent on the exhaustion of current selling pressure. Conversely, a slip below $40,000 could ignite further selloffs. The battle between bullish and bearish sentiments is set to define the trajectory of 2022.

Billionaire Bill Miller's Bold Bitcoin Investment

Billionaire investor Bill Miller recently announced that approximately half of his investment portfolio is allocated to Bitcoin, showcasing a notably bullish stance. Miller, recognized for his early investments in Amazon and his previous role as chief investment officer at Legg Mason, boasts a remarkable track record of outperforming the stock market for 15 consecutive years from 1991 to 2005. While other prominent investors like Ray Dalio and Paul Tudor Jones adopt a more cautious yet supportive view of crypto, Miller is embracing a more aggressive approach akin to that of Michael Saylor.

He revealed that his portfolio consists of nearly 50% Bitcoin and 50% Amazon. Having acquired BTC in 2014, he significantly increased his holdings in early 2021.

Upcoming Trends in Altcoin Investments

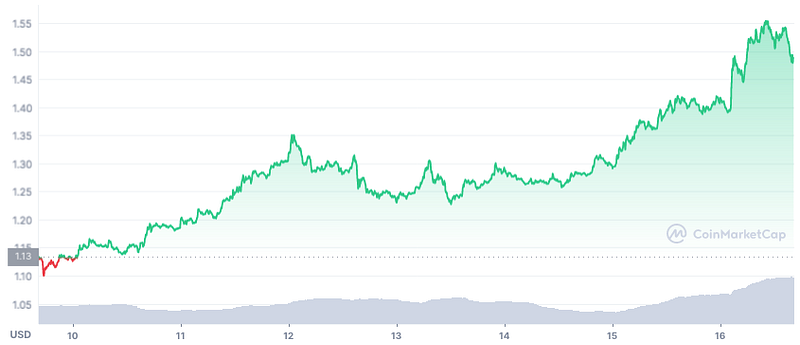

Among the various cryptocurrencies, Cardano (ADA) has distinguished itself this week. As the fifth-largest cryptocurrency by market capitalization, ADA has surged by 33% despite the broader market's stagnation. This price increase comes after a significant decline from nearly $3.00 in September 2021, with ADA currently trading around $1.50. I personally hold about 4% of my portfolio in Cardano as a strategic hedge against Ethereum.

Reflecting on Bitcoin's Origins

Earlier this week marked the anniversary of Hal Finney's first tweet mentioning Bitcoin back in 2009. Finney, who was among the first to mine Bitcoin, epitomized the spirit of the cypherpunk movement. A talented computer scientist, he balanced a successful tech career with a commitment to the ideals of privacy and decentralization that Bitcoin represented.

Despite his passing in 2014, Finney's contributions to Bitcoin's early development were invaluable. He maintained an optimistic view of the project, even as he dealt with the challenges posed by his ALS diagnosis. In his final posts, Finney articulated both his enthusiasm for Bitcoin and his thoughts on passing his holdings to his children, reflecting on the nascent stage of Bitcoin's adoption at the time.

The Role of Crypto Mining

Recently, Ravencoin (RVN) celebrated its inaugural halving event, a significant milestone for this Bitcoin fork founded by notable figures in the crypto space.

Halving events, which occur every four years, result in a reduction of mining rewards, thereby enhancing scarcity and potentially driving demand. Although RVN experienced some positive price movement following the halving, the overall crypto market dynamics limited its potential for a significant breakout. I continue to retain all of the RVN I have mined since February 2021.

Final Thoughts

As we progress through January, keeping a close watch on the $42,000 threshold for Bitcoin is essential. A decisive movement in either direction could lead to a plunge into the high $30,000s or pave the way for a rally toward $50,000.

Thank you for reading! Please remember that I am not a financial advisor, and this content should not be construed as financial advice. All opinions expressed are solely my own. For more insights like these, consider subscribing to my weekly email newsletter.