Blur Dominates OpenSea: The NFT Marketplace Showdown

Written on

Chapter 1: The Rise of Blur in the NFT Arena

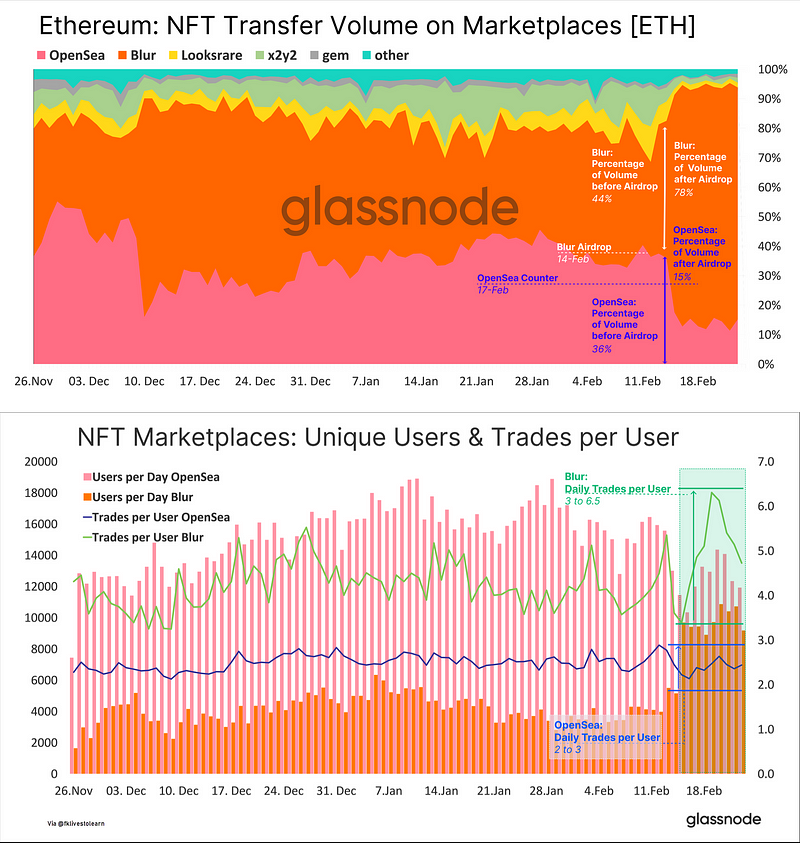

The NFT marketplace landscape has recently seen significant shifts, particularly with the emergence of Blur, which has rapidly gained popularity since its launch in October 2022. This platform has managed to capture an impressive 78% of the NFT transfer volume, overtaking the previous leader, OpenSea, following a successful airdrop on February 14th.

Despite ongoing regulatory discussions within the broader cryptocurrency market, Blur’s innovative zero-fee trading model and optional royalty payments have attracted many users, particularly professional traders. However, the value of its token has dropped by approximately 13% in the last week. Nonetheless, the recent airdrop has reignited interest in Blur, leading to a significant 34% increase in its market share while OpenSea's share fell from 36% to 15%. In response, OpenSea has adjusted its fee structure and policies.

Section 1.1: Understanding NFTs and Their Popularity Surge

Non-Fungible Tokens (NFTs) have surged in popularity, becoming a focal point for investors and digital art enthusiasts alike.

These adjustments made by OpenSea include temporarily waiving its fees, allowing optional creator earnings with a minimum of 0.5%, and enabling non-blocking of marketplaces with similar policies. Despite these efforts, the impact has been minimal, largely due to the distinct user demographics of the two platforms. OpenSea caters mainly to creators and collectors, while Blur targets professional traders.

Subsection 1.1.1: The Mechanics of NFT Trading

Blur has successfully incentivized market participation through its token rewards program, significantly enhancing market depth. This has led to an uptick in NFT sales frequency, thus improving the overall trading and liquidity experience for NFTs. Traditional measures of liquidity, based solely on trade volume, may not sufficiently capture the unique nature of NFTs. Instead, analyzing daily sales frequency per user can offer a more accurate insight into turnover rates.

Chapter 2: Market Dynamics and User Engagement

The first video, "OpenSea vs Blur: Tracking The NFT Marketplace War," explores the competitive landscape between these two platforms and the strategies they employ.

Blur leads the pack with an impressive 4 to 5 trades per user daily, compared to OpenSea's average of two. This higher frequency of transactions can create a flywheel effect, encouraging more sellers to list their NFTs on Blur, which in turn attracts more buyers.

The second video, "Blur Deep Dive: NFT Marketplace with Useful Advanced Features!!," delves into the advanced features that make Blur appealing to professional traders.

OpenSea’s recent fee reductions and royalty adjustments in response to Blur's rise could signal a transformative phase in the NFT market. As both platforms shift their focus from creators and collectors to traders, the value proposition of NFTs may evolve, positioning them not just as collector’s items but as a new asset class with enhanced liquidity and tradability.

Stay updated with insightful stories like this by following Faisal Khan on Medium.

Join my Mailing List to stay informed about the latest developments.