The Resurgence of Solana NFTs: Trends, Challenges, and Future

Written on

Chapter 1: The Current Landscape of Solana NFTs

As I sit down to write this at 2:13 am, I'm anxiously awaiting the minting of Cryptografs for which I secured a whitelist spot. This has me pondering the risk versus reward of my choices. The whitelist situation has been particularly challenging for those of us in Australia. The previous mint I was eyeing was Sovana, which took place at 2:30 PM UTC (1:30 am my local time), and most mints seem to occur in the dead of night.

Flipping mints on Solana for returns of 1 to 3–4 times hardly seems worthwhile, even if it translates to gains of 100–300%. In reality, it amounts to just a few hundred dollars. While many in the market focus on mints, the true value—and enjoyment—appears to lie in secondary markets, where one can back teams that consistently innovate, as liquidity moves from one mint to another.

Transitioning from Ethereum to Solana, the absence of gas fees makes engaging with marketplaces and minting a pleasure. If my mint fails? No problem! I can keep hitting the mint button without incurring extra costs. Listing items on marketplaces is also straightforward, with minimal fees. On Opensea, listing a new collection requires gas fees, necessitating careful consideration of those costs in your overall purchase price.

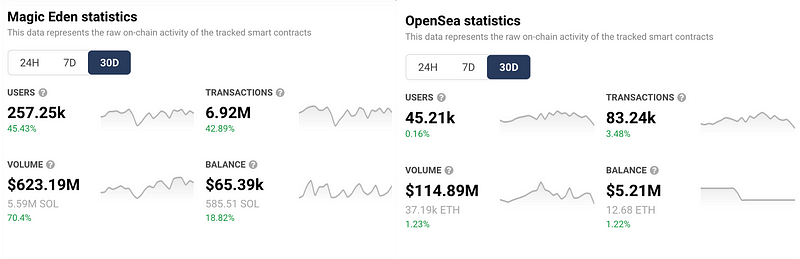

The downside of low transaction fees is that I've found myself making more trades on Solana, as each choice feels less consequential. The contrast between transactions on Magic Eden, Solana's leading marketplace (for now), and Opensea is staggering: 6.92 million versus 83,240.

6.92M transactions vs 83.24k - Source: Dappradar

When comparing the Solana ecosystem to Ethereum, several concepts become clearer due to the relatively immature market. For instance, understanding your position on the information hierarchy is crucial. It's been entertaining, albeit unhelpful, to observe accounts that originally shared valuable insights devolve into mere meme-makers as they gain popularity.

Section 1.1: The Risk of Rugs and Market Dynamics

The space is unfortunately rife with rug pulls, which drain liquidity from an already limited market. The most recent example that comes to mind is Balloonsville.

The current market dynamics do not seem to favor innovation or community building; instead, it appears to lean towards Ethereum derivatives like Bored Ape Solana Club and SolPunks. The sustainability of higher floor prices for these projects—over those actively developing—is concerning.

Chapter 2: Insights from YouTube

In the video "Are Solana NFTs Back?", the discussion revolves around the current resurgence of Solana NFTs and what it means for the broader ecosystem.

The second video, "Solana NFTs Dominating | Is Blast a Rug and will Abstract be the Top L2?", analyzes the ongoing trends in Solana NFTs and raises critical questions about sustainability and innovation within the space.