Navigating Key Bitcoin Price Levels for 2022 Insights

Written on

Chapter 1: Understanding Bitcoin's Market Dynamics

Bitcoin began the year 2022 at approximately $47,000, embarking on a tumultuous journey alongside traditional financial markets. The world is grappling with persistent inflation, supply chain disruptions, an energy crisis, geopolitical tensions from the Russian invasion of Ukraine, and the lasting impacts of the pandemic. Despite these challenges, Bitcoin remains the leading cryptocurrency, attracting significant interest from major institutions. Notably, BlackRock has recently entered the conversation by providing exposure to Bitcoin through a private trust. Regardless of one's stance on cryptocurrencies, Bitcoin is here to stay. It's crucial to monitor these significant price levels throughout 2022.

Key Price Level: $20,000

$20,000 is a crucial psychological threshold that marks the previous market cycle's peak. Bitcoin nearly reached this level at the end of 2017 before experiencing a dramatic decline in 2018, which saw it plummet to around $3,000. Many investors believed we might never witness a $20,000 Bitcoin again. However, everything changed in December 2020 when Bitcoin surpassed $20,000, igniting a bull run that propelled it to nearly $70,000. Following this surge, when Bitcoin corrected, analysts speculated that either $40,000 or $30,000 might serve as new support. Instead, Bitcoin tested the $20,000 mark again, dipping into the low $18,000s in mid-June 2022.

The first video discusses the key levels to watch for Bitcoin in 2022. It highlights the importance of the $20,000 threshold and the market dynamics influencing Bitcoin's price.

Key Price Level: $30,000

For over a year and a half, $30,000 served as the support level for the current market cycle. Following the significant drop below $20,000, Bitcoin quickly approached $30,000. During the tumultuous early months of 2021, Bitcoin reached an all-time high near $64,000, coinciding with Coinbase's public listing on the Nasdaq. After a swift correction, Bitcoin rebounded past $60,000, only to face another drop. Throughout these fluctuations, it only dipped below $30,000 for a brief period on a few exchanges, reinforcing this level as a key support point.

As of mid-2022, while $30,000 is no longer viewed as long-term support, it remains a critical price point to monitor in the context of broader market conditions.

Key Price Level: $40,000

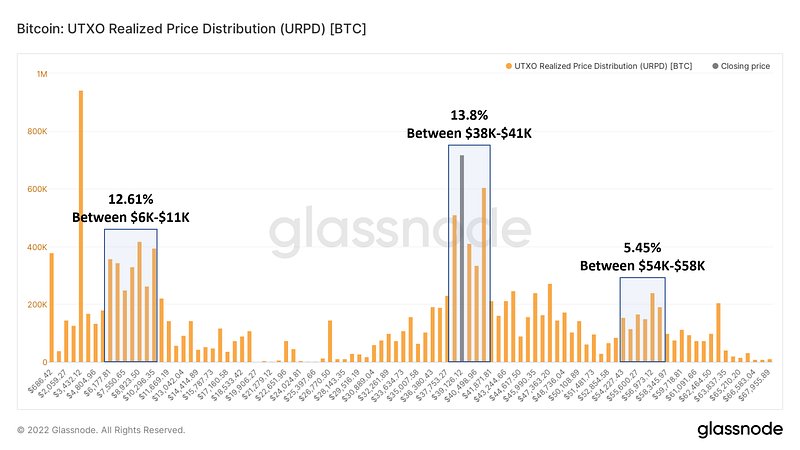

Approximately 13.8% of all Bitcoin transactions have occurred within the $38,000 to $41,000 range, making it a significant trading zone. From the beginning of 2022 to mid-May, Bitcoin oscillated around this level repeatedly, accumulating considerable trading volume.

Although $40,000 is currently about 40% above Bitcoin's prices near $24,000, it remains a crucial level to observe in this market cycle and beyond. It holds historical significance due to the volume of trading activity it has experienced.

Conclusion

As of mid-August, Bitcoin is trading between $23,000 and $25,000, representing a notable decline from its starting price this year. Amid ongoing volatility in various asset classes, questions arise regarding potential lows and the timeline for reaching new all-time highs. While the answers may take time to materialize, keeping an eye on pivotal price levels throughout the remainder of the year is essential.

The second video offers an updated price prediction for Bitcoin in 2022, examining factors that could influence its trajectory.

Additionally, the possibility of lower prices, particularly around $11,000, remains a concern. This range has been discussed among bears during recent downturns, although Bitcoin has not approached it closely. However, if global macroeconomic conditions deteriorate further, this price could come back into play.

While $40,000 may seem ambitious for a 2022 recovery, significant price movements can occur quickly in the crypto market. Whether or not Bitcoin revisits this level this year, it will be critical to watch as we approach 2023, especially with the next Bitcoin halving anticipated in early 2024, which typically spurs increased trading activity.